Official WeChat

Building Materials Industry Prosperity Index (MPI) for June 2025

I. Building Materials Industry Prosperity Index for June 2025

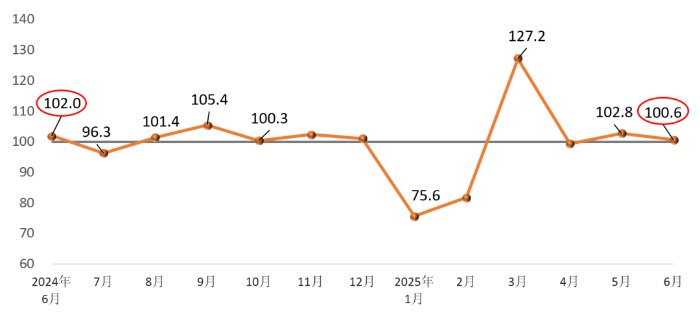

The Building Materials Industry Prosperity Index for June 2025 was 100.6 points, above the critical threshold, indicating an expansionary range. It decreased by 2.3 points compared to May and was 1.4 points lower than the same month last year, showing a trend of steady operation with slowing momentum in the building materials industry.

Monthly Building Materials Industry Prosperity Index

On the supply side, in June, the Building Materials Industry Price Index was below the critical threshold, while the Building Materials Industry Production Index was above it. Specifically, the Building Materials Industry Price Index was 99.8 points, down 0.6 points from the previous month; the Building Materials Industry Production Index was 100.7 points, down 1.6 points from the previous month. Overall, building materials product prices slightly decreased compared to the previous month, continuing a trend of low-level fluctuations, and production activity weakened compared to May.

On the demand side, the Building Materials Investment Demand Index, Industrial Consumption Index, and International Trade Index were all above the critical threshold, remaining in the expansionary range. Among them, the Building Materials Investment Demand Index was 100.3 points, above the critical threshold but down 3.8 points from the previous month, indicating slower growth in demand for building materials products in the investment sector. The Building Materials Industrial Consumption Index was 103.2 points, up 3.7 points from the previous month, reflecting increased demand from manufacturing industries that use building materials products. The Building Materials International Trade Index was 103.8 points, up 4.1 points from the previous month, indicating month-on-month growth in the foreign trade of building materials. Overall, in June, demand growth in the investment market slowed, while industrial consumption and international trade demand maintained growth.

II. Analysis and Early Warning of MPI Influencing Factors

Building materials product prices continue to stabilize with fluctuations. In June, among the building materials sub-sectors, product prices increased month-on-month in six industries: wall materials, lightweight building materials, lime and gypsum, mineral fiber and composite materials, architectural and sanitary ceramics, and non-metallic mining and dressing. Factory gate prices increased year-on-year in four industries: cement, clay and sand mining, building stone products, and mineral fiber and composite materials. Since the beginning of this year, building materials product prices have shown a continuous recovery trend. However, demand in the market remains persistently weak, lacking the momentum for price recovery.

Growth in building materials production slows. Since June, construction project progress has slowed in regions such as East China, South China, and Southwest China due to climatic impacts such as heavy rainfall and high temperatures, subsequently affecting production in related building materials enterprises. Apart from industries like architectural technical glass, mineral fiber and composite materials, architectural and sanitary ceramics, and non-metallic mining, the production indices of other building materials industries have declined to varying degrees compared to May.

The operating environment for building materials remains generally stable. The effects of policies such as urban renewal and the replacement of old building materials consumer goods are increasingly supporting the building materials market, driving positive changes in industries like insulation materials and composite materials, as well as the building materials consumer market. However, climatic factors such as high temperatures and rainfall have amplified their impact on the supply and demand of building materials. In May, China and the U.S. adjusted tariff policies. During the policy adjustment period, China's trade value of building materials commodities to the U.S. rebounded. However, subsequent tariff policies remain uncertain, posing potential volatility risks for building materials exports. Additionally, coal prices have continued to decline this year. As temperatures rise, coal demand is expected to seasonally recover. However, based on the current supply-demand situation and coal inventory analysis, coal prices are not expected to rise sharply. Natural gas prices have declined since May, benefiting building materials enterprises' production. Given supply-demand fluctuations and the relatively low prices of factors like coal, vigilance is needed against the risk of further declines in building materials product prices.