Official WeChat

Building Materials Industry Prosperity Index (MPI) for May 2025

I. Building Materials Industry Prosperity Index for May 2025

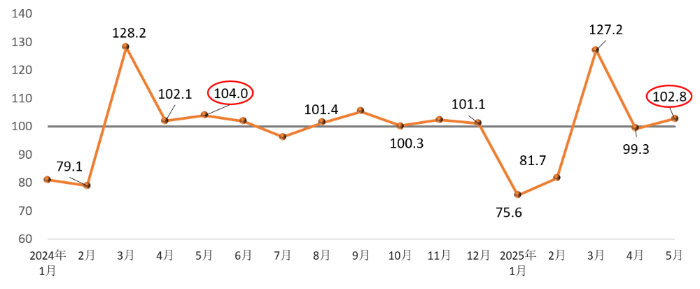

The Building Materials Industry Prosperity Index for May 2025 was 102.8 points, above the critical threshold. It increased by 3.5 points compared to April and is within the expansionary range, but 1.2 points lower than the same month last year. The May index indicates that the building materials industry experienced fluctuating recovery, though its performance remains weaker compared to the same period last year.

Monthly Building Materials Industry Prosperity Index

On the supply side, in May, both the Building Materials Industry Price Index and the Building Materials Industry Production Index were above the critical threshold. Specifically, the Building Materials Industry Price Index was 100.4 points, up 0.7 points from the previous month. The Building Materials Industry Production Index was 102.4 points, up 2.7 points from the previous month, returning to the expansionary range. Overall, building materials product prices improved compared to April, further consolidating the trend of low-level adjustment, and production activity among building materials enterprises increased relative to April.

On the demand side, the Building Materials Investment Demand Index was above the critical threshold and within the expansionary range, while both the Industrial Consumption Index and the International Trade Index were below the critical threshold, remaining in the contractionary range. Specifically, the Building Materials Investment Demand Index was 104.1 points, up 4.0 points from the previous month and above the critical threshold, with a level of prosperity essentially flat year-on-year, indicating stabilization in the investment demand market for building materials. The Building Materials Industrial Consumption Index was 99.5 points, up 3.0 points from the previous month, reflecting a recovery in demand from manufacturing industries that use building materials products, though still below last year's level. The Building Materials International Trade Index was 99.7 points, up 1.9 points from the previous month, indicating a narrowing year-on-year decline in foreign trade for building materials. Overall, the building materials consumption market showed structural adjustments in May, the investment demand market remained stable, while industrial consumption and international trade demand remained relatively weak.

II. Analysis and Early Warning of MPI Influencing Factors

Building materials product prices continued their steady recovery trend, showing a slight month-on-month increase. In May, among the building materials sub-sectors, product prices increased month-on-month in five industries: cement, concrete and cement products, clay and sand mining, building stone, and mineral fiber and composite materials. Year-on-year, factory gate prices remained higher in four industries: cement, clay and sand mining, building stone, and mineral fiber and composite materials.

The supply side of the building materials industry showed positive changes. Alongside the improved prosperity of the Investment Demand Index and the narrowing declines in the industrial consumption and international demand markets, production in the building materials industry accelerated month-on-month in May. With the exception of the non-metallic mining industry, production indices for all other sectors were within the expansionary range. Sectors such as lightweight building materials, insulation materials, waterproof building materials, building stone, and architectural and sanitary ceramics showed noticeable recovery in their production indices.

Overall demand in the building materials market remained stable, with volatility risks present in foreign trade. As various engineering construction projects accelerate, subsequent infrastructure investment demand is expected to recover further. The continued implementation of policies such as urban renewal and the replacement of old building materials consumer goods will enhance the foundational support for the building materials market. The impact of U.S. tariff increases on China and changes in the international trade environment, which became more pronounced starting in April, have affected order volumes for key exports to the U.S., such as architectural ceramics, sanitary ceramics, stone, and glass. These effects are gradually extending through the industrial chain to sectors like automotive glass, fiberglass, and photovoltaic glass. The uncertainty surrounding future tariff policy developments will increase volatility in the foreign trade of building materials products.