Official WeChat

Building Materials Industry Prosperity Index (MPI) for April 2025

I. MPI for April

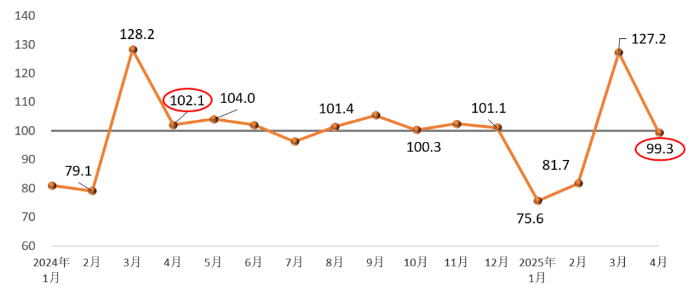

The Building Materials Industry Prosperity Index (MPI) for April 2025 was 99.3 points, falling below the threshold and down 27.9 points from March, indicating non-prosperous conditions and weaker performance compared to the same period last year. Influenced by factors such as U.S. tariff increases and domestic and international market conditions, production of building materials and related downstream industrial products weakened, causing the MPI to drop into the non-prosperous range.

![]()

Chart: Monthly Building Materials Industry Prosperity Index

Supply Side:

- The building materials industry price index was 99.7 points, up 0.4 points from the previous month.

- The building materials production index was 99.6 points, down 28.4 points from March, reflecting weakening growth momentum and falling into the non-prosperous range.

Overall, the decline in building materials prices narrowed compared to the previous month, reinforcing stabilization at low levels. Production slowed compared to March.

Demand Side:

- The investment demand index was 100.1 points, down 26.1 points from March but remaining above the threshold, indicating stable construction demand.

- The industrial consumption index was 96.5 points, down 33.6 points, reflecting declining demand from manufacturing sectors using building materials and falling below the level of the same period last year.

- The international trade index was 97.7 points, down 47.7 points, indicating reduced activity in building materials foreign trade.

Overall, building materials demand experienced a slight decline in April, characterized by structural adjustments. Investment demand remained stable, while industrial consumption and international trade demand weakened.

II. Analysis and Warnings of MPI Influencing Factors

Price Stabilization Continues:

In April, six sub-sectors—wall materials, lightweight building materials, insulation materials, lime and gypsum, building stone, and mineral fibers and composites—saw month-on-month price increases. Four sub-sectors—cement, clay and sand/gravel mining, building stone, and mineral fibers and composites—maintained year-on-year growth in factory prices, continuing the stabilization trend observed since the second half of 2024.

Impact of U.S. Tariff Increases:

In April, orders for key U.S. export products such as architectural ceramics, sanitary ceramics, stone, and glass were directly affected. Additionally, major export products like automobiles and solar cells have extended their impact upstream to industries such as automotive glass, glass fiber, and photovoltaic glass, reducing demand for related building materials. The industrial consumption index for building materials fell into the non-prosperous range, while production indices for architectural glass, sanitary ceramics, and building stone dropped below the threshold.

Structural Changes in Market Demand:

This year, the acceleration of key construction projects and policies such as urban renewal and the replacement of old building materials with new ones continue to provide foundational support for the market, stabilizing investment demand. In April, production indices for cement, concrete, and cement products remained in the prosperous range. However, evolving U.S. tariff policies have caused periodic fluctuations in demand for building materials-related manufacturing, increasing instability and uncertainty in international trade and impacting the supply chain.