Official WeChat

Building Materials Industry Prosperity Index (MPI) for March 2025

I. MPI for March

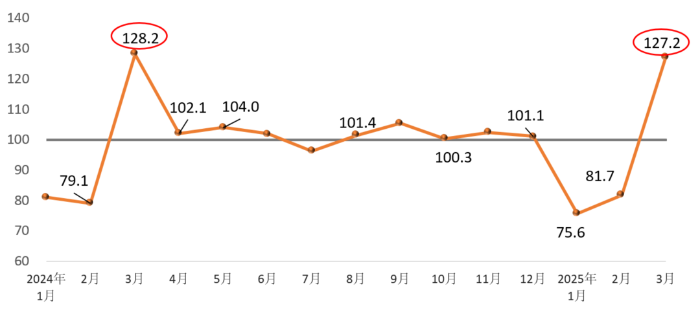

In March 2025, the Building Materials Industry Prosperity Index (MPI) reached 127.2 points, exceeding the threshold and entering the prosperous range. While showing significant recovery compared to January and February, the rebound was less pronounced than in the same period last year.

January and February are traditionally the "off-season" for the building materials market. Due to the Spring Festival holiday, downstream demand notably weakened, production slowed, and the MPI dropped below the threshold. After the holiday, as enterprises resumed work and production at a faster pace, industry prosperity began to recover. In March, with seasonal factors such as weather changes and the gradual recovery of demand in downstream construction and manufacturing markets, production accelerated significantly, driving a clear rebound in industry prosperity.

Chart: Monthly Building Materials Industry Prosperity Index

Supply side: In March, the building materials industry price index remained below the threshold, while the production index rose above it. Specifically, the price index was 99.3 points, up 0.5 points from the previous month, and the production index was 128.1 points, up 45.3 points from the previous month, moving back into the prosperous range. Overall, building materials prices continued to fluctuate at low levels but showed signs of stabilization in March. Production also improved significantly compared to January and February, contributing to the recovery in the MPI.

Demand side: The investment demand index, industrial consumption index, and international trade index all exceeded the threshold, remaining in the prosperous range. Specifically:

- The investment demand index was 126.3 points, up 44.3 points from the previous month, indicating a relatively clear recovery in the construction market, with prosperity levels largely consistent with the previous year.

- The industrial consumption index for building materials was 130.1 points, up 49.2 points from the previous month, reflecting a faster recovery in demand from related manufacturing sectors compared to the same period last year.

- The international trade index for building materials was 145.5 points, up 85.5 points from the previous month, showing accelerated recovery in building materials trade after the Spring Festival.

Overall, building materials market demand exhibited a favorable recovery trend in March, driving the improvement in the MPI.

II. Analysis and Warnings of MPI Influencing Factors

Recovery in building materials market demand: With the implementation and impact of a series of growth-stabilizing policies since last year, many regions have accelerated the launch of construction projects. Infrastructure investment in January–February grew by 5.6% year-on-year, showing signs of recovery, though the real estate construction market still awaits revival. Products such as automobiles, solar cells, and electronic appliances maintained growth, with automobiles exceeding 10%, indicating an orderly recovery in demand from manufacturing sectors related to building materials. Sales of building and decoration materials in large-scale enterprises grew by 0.1% year-on-year, reversing the continuous decline since May 2024.

Stabilization of building materials prices at low levels: In March, among building materials sub-sectors, prices for insulation materials, building stone, mineral fibers and composites, and architectural and sanitary ceramics saw month-on-month increases. Five sub-sectors—cement, clay and sand/gravel mining, building stone, mineral fibers and composites, and non-metallic mining—maintained year-on-year growth in factory prices. Since the beginning of the year, the year-on-year decline in building materials factory prices has continued the narrowing trend observed since the second half of 2024, further indicating signs of stabilization at low levels.

Prudent assessment of building materials industry trends: Policies such as large-scale urban renewal and renovation and the "replacement of old building materials with new ones" for consumer goods are expected to effectively guide and support market expectations, potentially improving market sentiment, competitive dynamics, and supply-demand relationships. However, structural challenges within the industry persist, and its future trajectory will largely depend on establishing a dynamically balanced market supply-demand relationship and a healthy operational ecosystem. Additionally, factors such as the continued decline in coal prices, high and volatile oil and gas prices, and elevated road, sea, and river freight costs will differentially impact various building materials sectors, introducing volatility into the industry's operations.